The Iron Wallet: Fortifying Your Financial Future

In today’s rapidly evolving financial landscape, security is not merely an option—it is an imperative. As digital transactions proliferate and cyber threats become increasingly sophisticated, the quest for robust financial protection mechanisms has intensified. Enter the Iron Wallet, a term fast gaining currency among security-conscious individuals and enterprises alike.

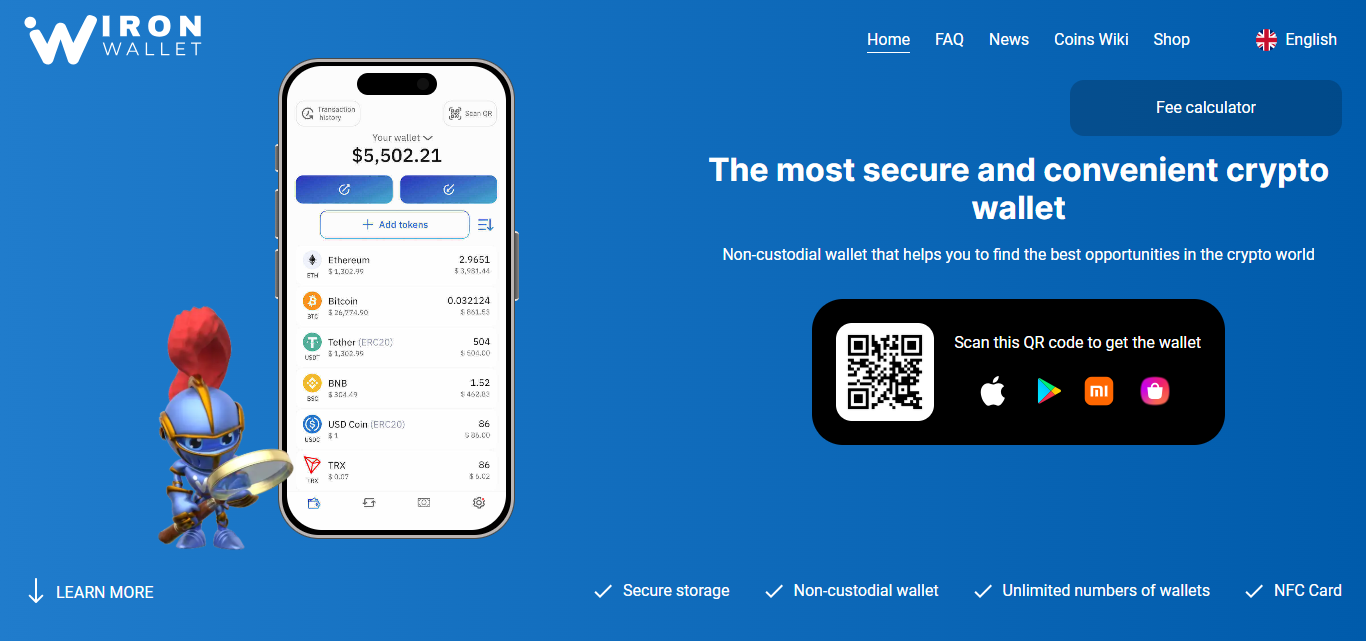

But what precisely is an Iron Wallet? Unlike conventional wallets—physical or digital—an Iron Wallet is conceptualized as an ultra-secure, meticulously fortified repository for storing valuable assets, both tangible and virtual. Whether it holds cryptocurrency private keys, sensitive documents, or multi-factor authentication devices, the Iron Wallet embodies a paradigm of security that far exceeds traditional norms.

The Anatomy of an Iron Wallet

An Iron Wallet is not a singular product but rather an amalgamation of best practices, cutting-edge hardware, and sophisticated encryption protocols. Typically, it integrates:

- Cold Storage Mechanisms: These are offline systems that house cryptographic keys or sensitive credentials, rendering them immune to online hacking attempts. Hardware wallets like Ledger or Trezor exemplify this, albeit an Iron Wallet goes a step further by incorporating additional layers of isolation.

- Tamper-Evident Features: Advanced Iron Wallet implementations include casings or seals that immediately show evidence of unauthorized access attempts. This serves both as a deterrent and a diagnostic tool.

- Multi-Signature Protocols: Rather than relying on a single point of failure, Iron Wallets often employ multi-signature (multisig) schemes, requiring multiple approvals before executing transactions.

- Biometric and Physical Security: Some Iron Wallet setups leverage biometric scanners alongside PIN codes, and are stored within secure vaults or safes that can withstand physical intrusion attempts.

Why the Iron Wallet Matters

The necessity of such ironclad security becomes evident when considering the magnitude of cybercrime. According to recent cybersecurity reports, billions of dollars are lost annually due to breaches targeting inadequately protected digital wallets and online banking credentials. In this hostile environment, the Iron Wallet emerges not as a luxury but a crucial safeguard.

Moreover, with the exponential rise of decentralized finance (DeFi) and self-custodied digital assets, individuals are increasingly responsible for their own security. Traditional banking institutions offer insurance and recovery processes; however, in the decentralized realm, once private keys are compromised, recovery is often impossible. Thus, an Iron Wallet’s uncompromising security architecture becomes indispensable.

Strategic Advantages: Beyond Simple Protection

Beyond mere protection, adopting an Iron Wallet framework cultivates a proactive security posture. It engenders a mindset that prioritizes long-term asset preservation over short-term convenience. This has profound implications, especially for institutional investors managing substantial portfolios.

Additionally, Iron Wallet practices often integrate redundancy—such as geographically distributed backups of encrypted key shards—ensuring that even catastrophic events (fires, floods, or geopolitical turmoil) do not obliterate access to critical assets. This level of resilience epitomizes best-in-class risk management.

Implementing Your Own Iron Wallet

Transitioning to an Iron Wallet approach requires thoughtful planning. Here are some algorithmic steps to guide the process:

- Asset Inventory: Catalog what needs protection—be it cryptocurrency, confidential legal documents, or corporate secrets.

- Threat Modeling: Analyze potential risks including hacking, theft, or even internal sabotage. This shapes the required security layers.

- Tool Selection: Choose appropriate hardware wallets, encrypted storage systems, and tamper-evident enclosures.

- Access Protocols: Implement multi-signature and biometric measures, minimizing single points of failure.

- Secure Backups: Create distributed, encrypted backups stored in separate, secure locations.

- Periodic Audits: Regularly test and update security protocols to counter evolving threats.

Conclusion: The Future of Financial Fortification

In summation, an Iron Wallet is far more than a heavily locked box—it is a holistic, adaptive security ecosystem designed to anticipate, withstand, and outmaneuver the multifaceted threats of the modern era. As we advance deeper into a digital-first economy, those who prioritize such fortification not only secure their assets but also position themselves as prudent stewards of their own financial destinies.

Whether you are a retail investor dabbling in crypto or a multinational entity managing vast digital treasuries, adopting the Iron Wallet ethos is arguably the most rational insurance you can procure against an increasingly uncertain digital world.

Made in Typedream